The Pipeline, Part II

The Center for Urban and Regional Policy (CURP) at Northeastern University has a series of presentations online here. They contain a wealth of information on the regional economy, housing, development and demographics.

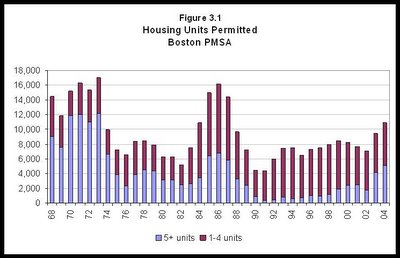

The following plot contained in several of the presentations shows housing units permitted in the Boston PMSA over the last 36 years. The boom-bust cycle is apparent - as is the recent growth in multi-unit permitting.

In my last post, I quoted Global Insight from this Boston Globe article (12/30/2005) estimating that "there will be 16,220 housing starts in the Boston metropolitan area this year." Add that info to this graph and what previously looked like an orderly growth in permits now looks a lot more like past boom-bust cycles.

The CURP website also introduced me to this, from CHAPA, the Citizens' Housing and Planning Association:

A picture is worth a thousand words.

-DT

1 comment:

What a great blog. Thanks for all the stats. I do think you're reasoning is sound as far as it goes, but is not complete for 3 reasons. First, the pipeline does indeed show 13,000 units permitted in 2004, of which 7,000 are single family (most, by the way, adult community housing) and 6,000 multi-family. Most of the latter is affordable housing - about 4,000 units. This leaves 2004 permits for only 2,000 market-rate units.

Against this rather smallish new supply, the same stats show an increase of 25,000 jobs in 2005. Even providing for an increase in 2005 permits, the new supply remains thin given that Boston is projected to increase jobs by another 20,000-30,000 in 2006 (see Bureau of Labor Statistics), resulting in demand for at least 10,000 new housing units (jobs vs. new supply is the other critical element of supply-demand analysis: see Meyers Group's website).

A second missing element: nowhere do you mention the impact of the hurricanes late last summer on the increase in housing inventory. Buyers hesitated for a period of 8 weeks, but judging from sales activity the last two months they are buying now. If we can at least partly attribute the increase in inventory to this exogenous shock, as opposed to any fundamental or structural change in demand, we may find the current buyer's market is artificial and last only as long as it will take to absorb the existing inventory, which seems to be 9 months vs. trailing 12 months sales.

Third, you should consider the divergence in single-family vs. condo sales and prices, a divergence that may reflect the increasing number of empty nesters and young professionals seeking condos close to the city (and selling large homes in the suburbs). (It would be great to see your analytical powers take that problem on!)

The bottom line: based on the data, the excess of new demand from job growth over new supply may result in net absorption this year. Or maybe not: but the fact is that the housing market will turn on unknown variables: the amount of job growth, interest rates and outmigration. All are unpredictable. However the chips fall, in the absence of a recession a price correction is unlikely to hit anywhere close to 30%. The study you cite seems about right to me: -3% this year as the industry makes concessions, and then slight appreciation from 2007 on.

Post a Comment