Affordability - Stretched to the Max?

The issue of "affordability" is complex. It combines elements of income, cash available as down payment, mortgage interest rates, creative mortgage practices, and ofcourse price.

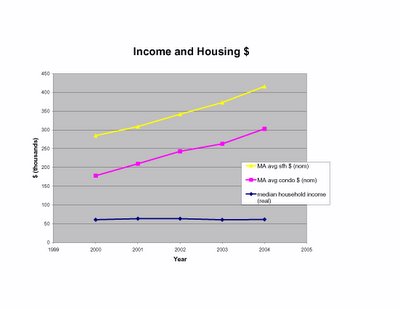

The simplest argument in support of rising prices: incomes are rising in tandem to support the prices. One look at the image below refutes this notion in MA.

Real household incomes (adjusted for inflation) have been stagnant in MA for the past five years. The average home price has increased 46% and the average condo 70% over the same timespan. Yes, I've compared inflation adjusted income to non-inflation adjusted house prices, but one could easily argue that since house prices aren't included in inflation measures (rents are), then real income is the proper comparison.

Real household incomes (adjusted for inflation) have been stagnant in MA for the past five years. The average home price has increased 46% and the average condo 70% over the same timespan. Yes, I've compared inflation adjusted income to non-inflation adjusted house prices, but one could easily argue that since house prices aren't included in inflation measures (rents are), then real income is the proper comparison.

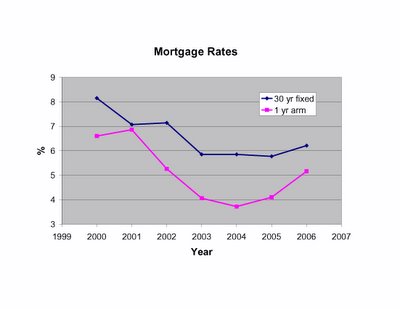

So how to account for people's ability to afford these prices? The cost of borrowing money reached multi-generational lows in the last 4 years. Here are the 30 yr fixed, and 1 yr ARM rates on January 1 of the past 7 years. No question, low rates increased the purchasing power of those stagnant incomes. Couple this with the well-marketed message that only "monthly costs" are important, and suddenly people could afford to pay higher prices for an asset using "affordable" monthly payments.

No question, low rates increased the purchasing power of those stagnant incomes. Couple this with the well-marketed message that only "monthly costs" are important, and suddenly people could afford to pay higher prices for an asset using "affordable" monthly payments.

Here's where things get worrisome. The escalating prices, and the psychology of "real estate never goes down," and "get in now or you'll be left behind" led inevitably to panic buying, bidding wars, and speculation.

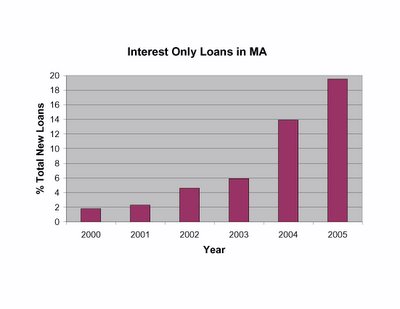

Nothing epitomizes speculation better than interest-only mortgages. (I know they can be a cash-flow tool for the financially savvy, but come on, how many IO loans are being used that way?) Take a look at the explosive growth in IO mortgages in MA as people have been stretching to purchase inflating assets.

Keep in mind, with these loans no principal is payed for a defined period. The principal is then payed down on an accelerated basis after the interest only period - leading to payment shock. The only equity accrued during the IO period is through price appreciation - and the only way to refinance these mortgages without spending a big pile of new $ is to have some equity. If you want to see some amazing home-financing horror stories, and get a sense of the crazy lending practices that got us to this point, check this blog out.

Keep in mind, with these loans no principal is payed for a defined period. The principal is then payed down on an accelerated basis after the interest only period - leading to payment shock. The only equity accrued during the IO period is through price appreciation - and the only way to refinance these mortgages without spending a big pile of new $ is to have some equity. If you want to see some amazing home-financing horror stories, and get a sense of the crazy lending practices that got us to this point, check this blog out.

Even if you can refinance, the rise in short-term interest rates almost guarantees some amount of payment shock. What happens if you can't afford the new payments? Sell, or face foreclosure. If you don't have any equity, selling is a $ losing proposition. MA foreclosures rates have already begun to climb.

And I haven't even talked about the enormous value of adjustable rate mortgages in the US that will begin resetting in 2006 ($300 billion) and 2007 (a staggering $1 trillion), and are already creating problems for MA borrowers.

So have people really been able to afford the homes they have purchased over the past few years? Perhaps more importantly, will they continue to be able to afford their payments? The answer to these questions will likely have far-reaching consequences for the local, and even global economy.

No comments:

Post a Comment