Soft-Landing, or Meltdown?

The recent housing numbers out of Massachusetts confirm that a decisive downshift in the market is in progress. Some observers, especially those in the real estate business, continue to argue for a leveling of prices at a new plateau, and a soft-landing for house prices and sales. I'd like to present several recent news pieces that paint a decidedly bleaker picture - one that points to sustained weakness that will wrench the speculative excess from current prices.

Let's start with demand. We first reported on the stagnant/declining population in MA back in January. This recent story from the Boston Herald emphasizes that the exodus from Boston proper continues unabated.

People are leaving Boston at a stunning rate of about 27 a day - with nearly 10,000 bolting Suffolk County last year alone, according to new U.S. Census Data. That’s more than 1 person bailing out on life in the Hub every hour... The county’s population was about 654,428 in 2005 - off 5.3 percent, or 36,795, from a recent peak in 2001 of 691,223, according to census estimates.

Later we find out where the escapees may be going, if they're not leaving the state altogether:

Many people are moving to smaller cities such as Brockton and Lawrence or moving to the outer suburbs in the Route 495 area to find cheaper housing...

But not to worry says Seth Gitell, spokesman for Mayor Menino, who noted:

Boston is currently undergoing a historic housing-construction boom, proving people want to live and work in the city.

Guess what Seth, increasing supply does not guarantee demand. Moreover, the people moving to Brockton and Lawrence aren't candidates for the major trend in Boston housing, the million dollar (and up) condo.

But surely the wealthy people of Boston will provide an endless stream of demand for uber-chic city living, right? Maybe not for long, according to this recent report from the Boston Globe:

With a wave of new condominium units now available in Greater Boston, real estate developers are offering incentives to boost sales and move hard-to-market units. Developers are often willing to pay closing costs, forgive monthly maintenance fees for a year, or throw in amenities such as free hardwood floors. These incentives are rarely advertised, but buyers, sensing that the leverage in negotiations is shifting in their favor, are bargaining harder for extras.

''All of a sudden, in the last year, there are so many projects that we haven't really been facing this kind of surge of units and projects in the city before," said Lili Banani, a Back Bay agent for Coldwell Banker Residential Brokerage. ''There's a lot of competition, and that's why you see more of these incentives."

The market for single-family homes in the suburbs slowed considerably in 2005, but Boston's condo market remains strong as aging baby boomers downsize their lives and first-time homebuyers find condos more affordable than houses. Yet there are currently about 1,350 downtown condos for sale, up from 880 a year ago, according to Listing Information Network, which tracks that market.

And the pipeline is full of new construction and apartment-to-condo conversions. The Boston Redevelopment Authority recently estimated that 14,000 residential units are under way or approved, and, over the next five years, an estimated 1,000 new units will come on the market annually. That's on top of existing units that would come on the market due to normal turnover in the real estate market. (emphasis added)

So let's summarize: we've got a shrinking population and growing supplies. But surely those who've already bought have nothing to fear, secure in the equity gains of the preceding bull market? Not so fast, says the Christian Science Monitor:

If the nation's real estate boom collapses, its first victims may well be low-income minorities and immigrants in a big US city like Boston. That is the picture emerging here as foreclosures rise and the housing prices falter. More than one-quarter of Boston's mortgage-holders appear to be stretched thin financially, spending at least half their income on housing, according to an analysis of census figures. That's more than twice the national average and the highest of any major city except Miami.

In Boston, a shift in market forces is now putting many of these vulnerable homeowners into a double bind. Rising interest rates are pushing up the costs for those who have adjustable mortgages. At the same time, these homeowners are finding it harder to sell.

"I would suspect that as home prices soften, you are probably going to see a ramp-up in defaults, delinquencies, and foreclosures," says Nicolas Retsinas of the Joint Center for Housing Studies at Harvard University. "It is not that they were not stretched before, but if you couldn't make the mortgage payments, you would sell. If the market is softer, it is not as easy to do this."

Clearly, at the low end of the economic scale, the situation in Boston housing is tenuous. What could tip the scales? How about jobs, especially for dual income couples. More bad news on this front, from the Boston Globe:

The state's unemployment rate rose from 4.6 percent to 5 percent in February, the first time in more than decade that the state's rate has exceeded the nation's jobless figure. The last time the state's rate was higher than the nation's was March 1995.

The number of jobs in the state has grown by nearly 45,000 since December 2003, but is still about 160,000 jobs below the state's historic peak employment in February 2001.

That last figure is stunning. Between February 2001 and December 2003, Massachusetts lost more than 200,000 jobs, only a quarter of which the state has since regained. During that same time, population in the state was declining. And prices? They kept on going up. Why? In no particular order: momentum, speculation, record-low interest rates, and easy lending. But guess what? These remaining supports are melting away, and there is nothing left in their place but brave talk, blind faith, and over-priced houses.

Let me end with an excerpt from Realty Times, reporting on the New Hampshire market, that I think also sums up the current situation in Massachusetts:

For investors who are grabbing an opportunity to sell (because the market may go lower, or their adjustable rate mortgage may go higher) their motivation to sell at almost any price could be quite strong (waiting won't help.).

For newly-weds who want to buy their first house, there are values if they are patient (waiting will help.).

For move-up buyers, who need another bedroom, or a better school system, there are some great values, but they will probably not get all the money on the resale of their existing house (waiting probably won't help).

For old-time Yankees who heard their farm might be worth a couple of million dollars -- that was last year (waiting didn't help.),"

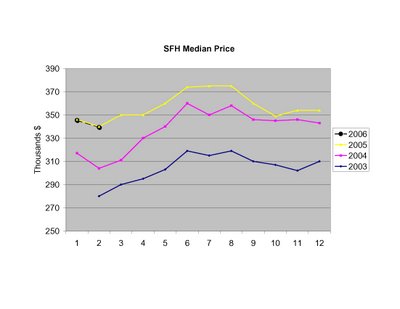

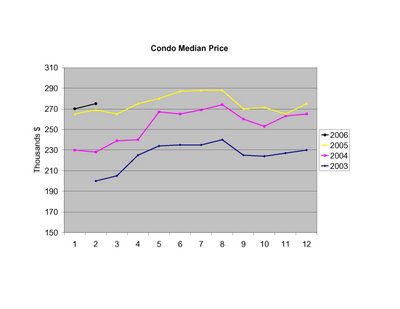

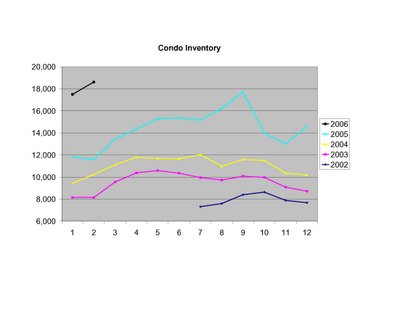

These plots graphically emphasize the deceleration in price trends - just look at the jump in prices from February 2004 to 2005, and the flat prices from 2005 to 2006.

These plots graphically emphasize the deceleration in price trends - just look at the jump in prices from February 2004 to 2005, and the flat prices from 2005 to 2006.

More analysis over the next few days as time permits. In the meantime, surf on over to the Real Estate Cafe for more discussion of the February numbers (

More analysis over the next few days as time permits. In the meantime, surf on over to the Real Estate Cafe for more discussion of the February numbers (