It's All About Supply and Demand

Back in January (original post here) I explored how the inventory of houses for sale influences appreciation rates. Now that we've had a couple data points in 2006, I thought it was time for an update.

Plotted below is the "Months Inventory" over the past 3+ years. I simply divided the total number of houses and condos for sale in any month by the total number of sales in that month, as reported by the Massachusetts Association of Realtors. As you can see, inventories follow a pattern through the year, typically peaking in February as homes come on the spring market, and sales reach their low. In the fall of 2005 inventories broke out of their typical trend behavior, and in 2006 the deviation from the trend has accelerated.

I've also plotted the average annual inventory for each of the last three years (dashed colored lines). Note that over the last three years, a quite reasonable forecast for annual inventory could be made using data from the first two months - the annual average tended to be ~1 month below January levels, and ~3 months below February. Applying this admittedly simplistic analysis to 2006, we can predict annual average inventories of ~13 months. While plenty can change in the coming months, this should provide a rough estimate, and is likely conservative given the recent trend to the upside.

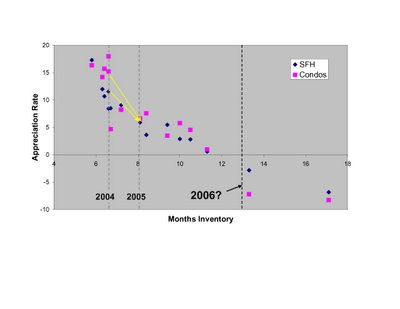

Now we can look at how appreciation rates for single family homes (SFH) and condos have correlated with annual inventories, using data from MAR over the past 14 years. I've highlighted the inventory levels for 2004 and 2005 (gray dashed lines), and the deceleration in appreciation rates over the same time span (yellow arrows). I've also incorporated the forecast for 2006 inventories (black dashed line).

Given the sparcity of data at these high inventory levels, it's not advisable to be too specific with predictions. But clearly, given the growing imbalance between supply and demand, the peak in median prices is well behind us; YOY declines in prices should accelerate as the year continues.

4 comments:

What a great web log. I spend hours on the net reading blogs, about tons of various subjects. I have to first of all give praise to whoever created your theme and second of all to you for writing what i can only describe as an fabulous article. I honestly believe there is a skill to writing articles that only very few posses and honestly you got it. The combining of demonstrative and upper-class content is by all odds super rare with the astronomic amount of blogs on the cyberspace.

I have bookmarked, Dugg, and I joined the RSS subscription. Thanks! ….

Dominican Republic Real Estate

i truthfully enjoy your own writing kind, very remarkable,

don’t give up as well as keep writing due to the fact that it simply just worth to follow it. looking forward to see a whole lot more of your current well written articles, enjoy your day

Greenville Plumber

it used to be abut supply and demand but know it is about politics and intervention where market signals are hardy reliable.

fix credit houston

This is a nice stuff that you have introduced. Splendid work. Thanks so much for posting your experience online!

Hilton hotel cincinnati

Post a Comment