October sales, prices, and inventory

MAR (here) and the Warren Report (here) recently released Massachusetts housing market data for October.

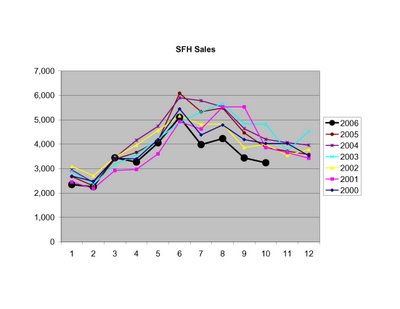

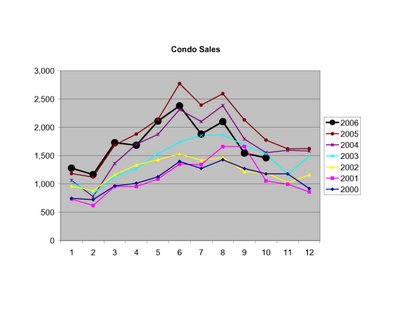

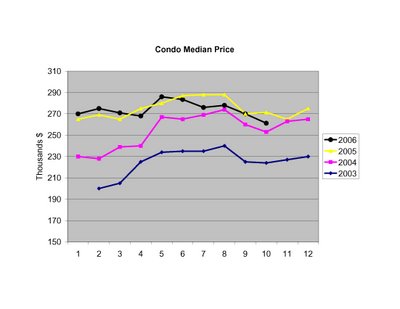

According to MAR: this October SFH sales were down 16.5% and prices were down 2% from October 2005; condo sales were down 17.6% and prices were down 3.7% over the same interval (see below for historical plots). While the decrease in sales is smaller than in the previous few months, keep in mind that last October was already a weak period so the comparisons are getting easier. In fact, single family home sales this year were off 23% from Oct. 2004, and 33% from Oct. 2003.

The Warren Report numbers, which are more inclusive, show SFH sales off 14.9%, and prices down 6.9%. Meanwhile, condo sales were off 19.5% and prices were down 4.8%.

Here are the historical trends for sales according to MAR data:

Here are the historical price trends, again according to MAR data:

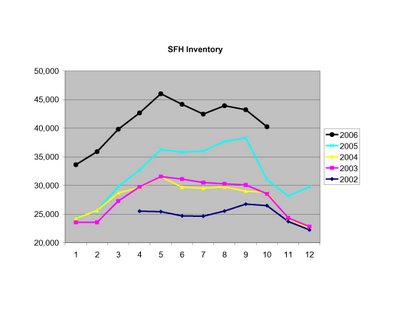

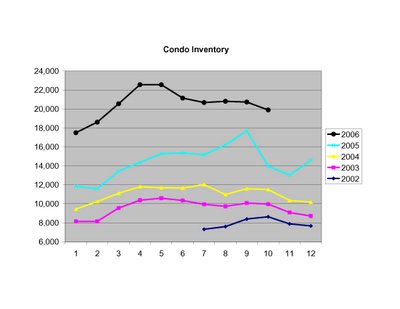

To put the current unsold inventory into perspective, here are the historical numbers according to MAR:

To put the current unsold inventory into perspective, here are the historical numbers according to MAR:

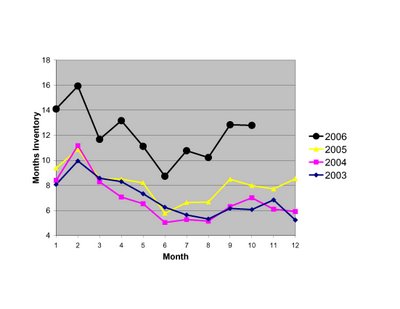

Finally, here is a look at months inventory (total SFH and condo inventory/total sales):

Finally, here is a look at months inventory (total SFH and condo inventory/total sales):

While certain parties continue to spin these numbers as best they can, Wellesley College housing economist Karl Case puts them into the proper perspective (House prices plunge): "All of the indicators - sales volume, prices, everything - are pointing downward."

3 comments:

I agree with walthamite. The article, entitled "Home Prices Plunge," is totally sensationalist.

It says that single family home prices in Suffolk county, which is mostly Boston, dropped 13%, but condo prices rose .8%.

But THE VAST MAJORITY of the inventory in the Boston and Suffolk County area is CONDOS. According to the Warren Group's Townstats (see their website), the core Boston area (which they define as the Back Bay, Beacon Hill, North End, South End only) had 3 Single Family Home sales in October - that's right, 3. Versus 159 Condo sales. These compare to 4 Single family home sales last year, versus 162 condo sales. Condo prices INCREASED from $512,000 to $572,000 in that market.

Brookline SF sales were also a fraction of condo sales: 14 SF sales (actually an increase from 6 last year) vs. 43 condo sales (down from 48 last year). SF prices increased from $803,000 to $1.159 while condo prices INCREASED from $414K to $430K.

Allston, Brighton, Dorchester, Jamaica Plain, Roxbury, etc. - condos represent 80%+ of the sales figures for almost all Suffolk County towns.

The real story is that prices for Suffolk County condos - the main form of housing in its various towns - increased in October, especially in the core urban market, despite much higher interests rates (at time of contract in August and September) compared to last year.

indigo: I think I have misunderstood you. How will we "test the 1991 lows shown in the MAR sales data"? Here are the MAR figures for every October since 1991:

SF Sales Condo Sales

Oct-06 3,239 1,464

Oct-05 3,880 1,777

Oct-04 4,249 1,548

Oct-03 4,364 1,376

Oct-02 3,781 1,110

Oct-01 3,812 1,063

Oct-00 3,900 1,114

Oct-99 4,002 1,143

Oct-98 4,374 1,050

Oct-97 4,468 957

Oct-96 3,878 747

Oct-95 3,278 656

Oct-94 2,923 560

Oct-93 3,288 628

Oct-92 2,818 438

Oct-91 2,229 337

These numbers show October 2006 SF sales to be 50% higher than October 1991. Condo sales are 500% higher. Total housing sales (SF+Condos) are 80% higher last month than October 1991.

The data shows that the decline in SF sales has been ongoing for at least 4 years. During the same period condo sales increased; now they are declining state-wide as well.

BUT IN THE URBAN CORE MARKET (mainly central Boston, Brookline, Cambridge, Somerville) CONDO SALES ARE ABOUT EVEN WITH LAST YEAR'S RECORD SALES, while condo prices on the whole in these core markets are HIGHER.

These numbers are consistent with two major demographic trends of the last 5-10 years: the continuing yuppification of the urban core market and the decline of families with children in the suburbs.

It is completely appropriate, I think, to speak of an implosion in housing demand in the suburbs (though there are exceptions, of course), but to speak of an implosion in the whole state is to miss the crucial secular shift in demand from SF suburban homes to urban condos, where demand and prices have been remarkably resilient despite higher interest rates.

I would like to comment about US corporations the problem is not a lack of profitable. Many Us companies have lots of money for share buybacks. But little money for employee compensation. How can anyone afford a house payment of 1500 dollars a mouth If their annual income from their job is just thirty thousand dollars a year.

Post a Comment