Sales and Inventory Trends

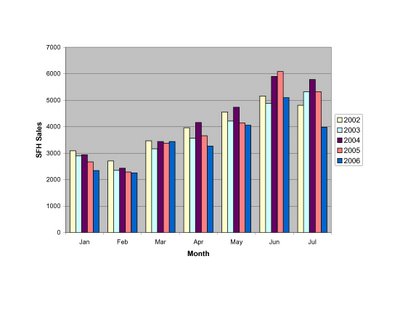

As detailed in the previous post, sales in MA in July were weak across the board. For comparison, here are the monthly sales figures (up to July) for the last 5 years: The slowdown in SFH sales appears to be accelerating this summer.

The slowdown in SFH sales appears to be accelerating this summer.

Monthly condo sales were at record levels as recently as the 1st Q of 2006, but this summer sales have slowed rapidly, retreating to ~2003 levels in July.

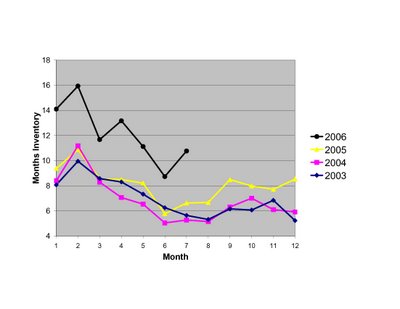

Months inventory for the market as a whole continues to paint a picture of weakness, although the surge in inventory from 2005 levels has slowed. The bigger problem now is with slowing sales.

3 comments:

PRICES: UP OR DOWN?

DT as always nice post.

Some thoughts: Sales prices seem to have decreased in line with interest rates: a 1% increase in interest rates = a 20% increase in monthly payments over 12 months, or 14% after adjusting for the tax benefit. Since personal income is up 4% over the same period, that results in a 10% net increase in the carrying cost (or, 10% decrease in purchasing power or affordability), resulting in a 10% decrease in the price of a house, all other conditions held equal. Given inelasticity in pricing (eg. sellers not adjusting prices down 10% across the board), many buyers have been priced out, resulting in lower demand.

I believe the actual sales price decline for the (theoretically) same sold house is greater than reported, since the reported decline applies to a smaller pool of houses chosen by pickier buyers (put simply, the median house now is a nicer house). Anecdotally, I think the actual decline is closer to 8%.

The data suggests that interest rates, more than a physical imbalance of supply and demand, have been the driving force behind the correction: most of the rate increase occurred from mid-spring 2006, eg. during the sales period reported as 2nd quarter sales (eg. March-May contracts, April-June closings), which is also the period where sales and prices declined the most.

Assuming job growth continues per trend (20-30,000 jobs per year), new demand should absorb new supply and perhaps some of the existing inventory.

Now, further increases in interest rates or a recession will result in a crash. Outmigration will also dampen demand. But if interest rates, the economy, and population hold, conditions as likely as they are unlikely, we may have hit bottom.

Sales vs. Inventory

Inventory numbers in the urban core markets (Boston, Cambridge, Somerville, Brookline, Charlestown) are much lower relative to sales. Also, the supply in these markets is mostly condos. In general, inventory seems to be at 4-6 months of ttm sales - not an unhealthy number.

It is true that sputtering SF sales in the suburbs is eroding demand for inmigration into the urban markets. But this relation suggests that the urban core markets will not see as much of a downturn as the suburbs.

Separately, the reduction in long-term interest rates in the last month (down 40-50bp from its heights) ought to increase demand (though it will remain lower than spring 2005, of course). Long-term rates are declining principally because of concerns about the economy.

In my view, the question now is: how many jobs will be created in the next 12 months? If enough to absorb new supply (and if the national economy does not heat up again so as to result in a rate hike), housing prices may just hold. If not enough jobs (especially if the rest of the country does heat up and rates rise), we will see inventory rise in the urban core markets - and that will spell more trouble.

Thanks for the charts Admin. Until July, MAR was always able to claim that although the number of sales is down, it is within the range of the last 4 years. No longer, as this analysis shows.

Regarding the months of inventory going down, that is a seasonal effect and I expect this number will shoot up as the summer fades.

goldenslot

GCLUB Casino

Gclub

GClub casino

Post a Comment