Spin City

MAR has 4th Quarter and 2005 market numbers out today. The Boston Globe has commentary from David Wluka, MAR president:

"The accelerated sales pace of recent years has all but ended, and we're returning to a more normal market," said the association's president, David Wluka. "Our strong seller's market has been replaced with a more balanced one that will help stabilize home prices."

Wluka is predicting continued moderation in prices. He said demand should remain high because of low mortgage rates and a bigger supply of unsold homes.

Pardon my ignorance, but exactly how will the increasing supply of unsold homes spur demand? This is realtor reasoning at its most wishful and non-sensical.

"Prices may soften, but look for flat to modest appreciation this year rather than sharp price declines," Wluka said.

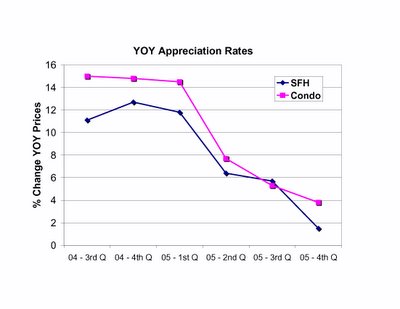

At least he didn't invoke the "soft-landing" phrase. Now that we've heard the spin, how about a dose of reality. Here's a look at YOY appreciation rates for the last 6 quarters, as reported by MAR:

Headed for a soft-landing? Looks more likely that the MA market is headed for a crash-landing.

No comments:

Post a Comment