The past few weeks have brought a flurry of housing news and statistics, accompanied by a rapid acceptance that prices in many parts of the nation are falling. The peak for the current market cycle has clearly passed in Massachusetts, and the key question now is: how low do prices go from here? It's commonplace to hear widely disparate estimates; many bulls project a modest drop then resumption of price stability or growth, while bears offer more dire predictions of collapse.

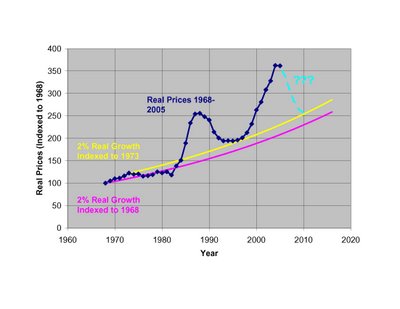

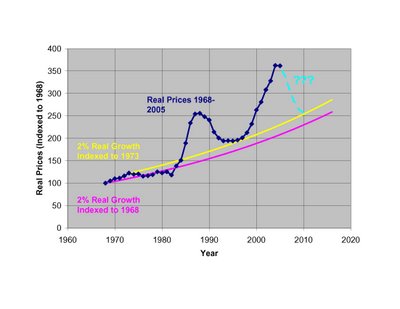

To try to cut through all the hype and hysteria, I thought it would be useful to look at the longest running data series I could find to see where we now stand. I settled on the Massachusetts Association of Realtors compilation of average sale prices for SFHs and Condos from 1968 to 2005 (the numbers are available as a PDF here). Note this data series differs slightly from other metrics in that it reports mean prices, not median, and SFH and condo prices are combined.

To filter out inflation effects, I adjusted prices using the CPI-U inflation numbers for the corresponding years (available here). I then indexed prices to a starting value of 100 for 1968, and plotted the the average real price (inflation adjusted for all subsequent years). Before looking at the plot, consider this point: if housing prices change proportionately with inflation, the plot would be a flat line. Clearly it is not. Periods of positive slope indicate prices increasing faster than inflation, while a negative slope implies prices that are rising more slowly than inflation, or falling.

It is commonly observed that housing prices over the long term rise ~1-2% faster than inflation. This historical relationship derives largely from the fact that incomes in America have, over the long term, risen faster than inflation. Hence, a higher standard of living, and the ability to pay more for housing. To help visualize what the long term trend might look like in an ideal world, I've included trendlines to show 2% real annual increases indexed to 1968 and 1973. You could do the same trendline starting with any year.

It is commonly observed that housing prices over the long term rise ~1-2% faster than inflation. This historical relationship derives largely from the fact that incomes in America have, over the long term, risen faster than inflation. Hence, a higher standard of living, and the ability to pay more for housing. To help visualize what the long term trend might look like in an ideal world, I've included trendlines to show 2% real annual increases indexed to 1968 and 1973. You could do the same trendline starting with any year.

If you believe in a fundamental relationship between income and home prices (as opposed to a "new paradigm" of ever increasing home prices uncoupled from income) and reversion to the mean, then clearly current prices are far from equilibrium trendlines (although interestingly, not as far in % terms as we were in 1986-7). Prices would need to drop ~36-42% in real terms to bring us immediately back into the long term trend range.

A more likely outcome is that prices will fall over the next few years, while inflation and wage gains will help to correct the current imbalance. I've plotted one such scenario in light blue, assuming CPI-U inflation of 4% in 2006, then 3% each year out to 2010, and nominal price declines of 2%, 6%, 6%, 3% and 0% from 2006-2010. The combination yields real price drops of 6, 9, 9, 6, and 3% over the same years, and brings the price index down 31% over 5 years and into rough equilibrium with the long term 2% real trendline (indexed to 1973). I'll be the first to say these are only rough guesses based on the previous down-cycle, so feel free to quibble with my predictions. What I think is more important is the visual impression this plot gives of the general scope and timing of the current price cycle, and the time and price changes that will likely be needed to correct the current imbalance.

Note: There is nothing magical about the 2% trendline indexed to 1973, and no reason to believe prices couldn't drop through it as they did in the late 1970's. I just find it intriguing that prices after the last cycled dropped almost exactly to this trendline in 1996-7 before beginning the latest up-cycle.

Quotes of the month in reaction to these numbers:

Quotes of the month in reaction to these numbers: It is commonly observed that housing prices over the long term rise ~1-2% faster than inflation. This historical relationship derives largely from the fact that incomes in America have, over the long term, risen faster than inflation. Hence, a higher standard of living, and the ability to pay more for housing. To help visualize what the long term trend might look like in an ideal world, I've included trendlines to show 2% real annual increases indexed to 1968 and 1973. You could do the same trendline starting with any year.

It is commonly observed that housing prices over the long term rise ~1-2% faster than inflation. This historical relationship derives largely from the fact that incomes in America have, over the long term, risen faster than inflation. Hence, a higher standard of living, and the ability to pay more for housing. To help visualize what the long term trend might look like in an ideal world, I've included trendlines to show 2% real annual increases indexed to 1968 and 1973. You could do the same trendline starting with any year.