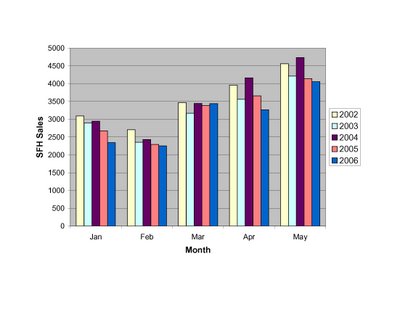

May Sales Volume Stats

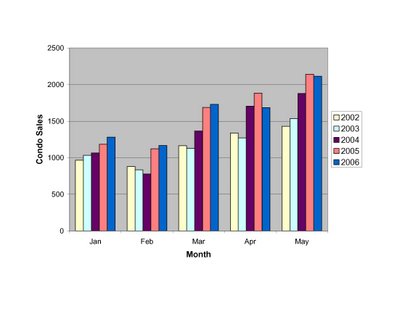

As requested by a reader, here are the monthly sales data for Jan-May as reported by the MAR. For comparison, the numbers are plotted relative to the past 4 years. As you can clearly see, monthly SFH sales have been gradually slowing for the past few years. So far this year only March 2006 escaped being weaker than each of the past 4 years. In contrast, Condo sales have continued to set records until the past couple months. A momentary blip, or worrying trend?

In contrast, Condo sales have continued to set records until the past couple months. A momentary blip, or worrying trend?

2 comments:

Great post as usual! I love how you graph everything to make it clear and easy to understand.

Jobs and the Big Picture.

It is interesting to note that 42,000 jobs have been created in the last 24 months (including another 2,000 or so in June). If anyone is interested in the jobs/demand side of the equation, take a look at the Bureau of Labor Statistics Massachusetts site:

http://stats.bls.gov/eag/eag.ma.htm

for monthly jobs growth statistics.

I know some people disagree about the relation of jobs to demand for housing. For what it's worth the housing industry does typically use the formula

projected job growth x current jobs / current number of households to predict demand for new housing.

The graphs here on inventory changes are exceptional and reader-friendly. But it is interesting to debate WHY inventory is increasing. In my view, any current ncrease in inventory can only be explained by

a) New construction is outpacing new demand: but this doesn't seem likely, at least not yet, since new home delivery in the Boston area (where most of the job growth has occured, hence where the new demand is) has trailed job growth, see my previous posts.

b) Demand for houses from net new job holders is less than net outmigration of retirees and other non-job holders (a contributing factor, since per the Census estimates, the Massachusetts population declined by 8,000 in the 12mos ending 7/2005)

c) Demand for housing is shifting, on balance, towards rental housing due to reduced confidence in the housing market or relative cheapness of apartments, esp. given rising interest rates. (But given that condos are often rented out, new condos may be shifted to the rental market if demand dries up.)

d) More people are grouping up and sharing a house

If rates stay under 7% and the new supply is absorbed by new jobs, we may see a continuation of the fairly stable price environment.

Post a Comment