The Bear Market Begins

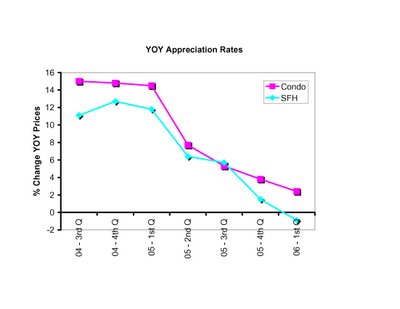

The Massachusetts Association of Realtors (MAR) released cumulative market numbers for the 1st quarter of 2006 today, accompanied by a press release (here). Overall, 1st quarter sales of single family homes were off 6.5% relative to the 1st quarter of last year, while condo sales were basically flat relative to last year. SFH prices dropped 0.9%, while condo prices were up 2.4% relative to 1st quarter 2005. I have some doubts about the condo prices they report, given that their own monthly reports for Jan, Feb, and Mar report YOY price increases for condos of 1.9, 2.2, and 2.2%. No way this could result in prices for the quarter being up 2.4%. Nevertheless, the downward trends in price appreciation that began in the second quarter of last year remains intact.

In one year we've decelerated from double digit price appreciation to flat or negative price appreciation. Those with the most interest in keeping the market afloat continue to paint lipstick on this pig (see the MAR press release, and the latest Boston Magazine - BUY, BUY, BUY), uttering all the reassuring phrases about normalization, healthier levels of inventory, soft-landings, buyer's market, etc.

But their reassurances seem to be failing. How do we know? A stunning article in the Boston Herald last week revealed that Coldwell-Banker is, brace yourself, pressuring SELLERS to LOWER PRICES!!! This admission, more than any other, signals the end of the bull market and the true beginning of the housing bear market in Massachusetts. Market participants are out of excuses (weather, hurricanes, wait for the spring market, etc.), and it's clear to almost everyone that the sellers vastly outnumber the buyers. Want to sell your house? Price below the competition, and be prepared to negotiate. First time buyer? Wait if you can. If not, take your time, find exactly what you want, and offer below asking (after all, prices will likely be lower in a year).

Don't believe me? Ask Fortune, who labelled the Boston housing market a "Dead Zone" that is 30% overvalued. They lay out a worst case scenario:

For the past few years the housing boom has driven the economy, adding jobs in construction, remodeling, and real estate services. And consumers gorged on the equity in their homes, taking out a total of $2 trillion via loans, refinancings, and sales over the past five years.

Those powerful stimulants, which added a full point to annual GDP growth, will soon vanish. If corporate spending or some other force doesn't come along to pick up the slack, we could go into a recession that would cut income growth to zero. Then inflated housing prices would have to shoulder the entire, wrenching adjustment, falling 30 percent or more over several years.

Why worry about a seemingly unlikely worst-case scenario? Take a look at the homebuilders, on the front lines of the housing market nationwide. Their confidence in the future of the market is falling like a rock, and has reached an 11-year low (link here), while their stock market values have been tanking (52-week lows today for PHM, CTX, HOV, RYL, DHI).

Given the hand-wringing at Coldwell-Banker, I'm guessing the April numbers (to be released next week by MAR) are not pretty, and the spring market will prove insufficient to reverse current trends. At that point reality will be harder to sugar-coat, pressure on 'must-sell' sellers will continue to ratchet up, and price declines should accelerate.

4 comments:

Inventory continues to climb, but demand and prices for condos seem to have held despite rising rates. What will the next 12 months hold? It will depend on job growth (currently 20,000/year), supply delivered (14,000 permits last year, but mostly elderly/affordable housing), population change (who knows? the last stats were from July 04-05, before the recent strengthening of job growth), and interest rate change (predict that and be a billionaire). The only conclusion to be drawn from the data is this: a) it's a buyer's market now b) who knows where it will be in 12 months. If one is buying to own for a few years, it still makes sense to go out there, low-ball, and buy.

Incidentally, this blog has gone from cool-headed presentation and analysis of data to an increasing use of rhetoric. To the three of us Harvard/MITers in this house, anyway, the rhetoric compromises your credibility.

Notsofastlouie-

Thanks for the comments, dissenting opinions are always welcome.

My take on your job growth argument is pretty simple: MA lost ~200,000 jobs between 2001 and 2003, but prices kept going up. To me that means that the correlation between prices and jobs is too weak to be meaningful.

I think inventory (normalized to sales) is a better indicator of price direction, as described in a number of posts. The last time inventory was this high (~1990-93) prices went down. And keep this in mind: from 1989-1993, while prices were flat or falling, 30 yr fixed mortgage rates dropped from ~10% to ~7%, improving affordability. Not a scenario likely to be repeated this time.

dt: True, there was an inverse correlation between job growth and demand during 2001-2003. But in 2000 tenant vacancy was under 1%, reflecting an extraordinary housing shortage after a massive 400,000 increase jobs with no corresponding increase in supply from 1996-2000. Rents increased 50%-100% during this period. During the recession the effect of job losses was countered by decreasing interest rates, which made housing more affordable, especially compared to the suddenly expensive rental market. As a result tenants turned into would-be homeowners. Even with the job losses and conversino of tenants into condo-owners, vacancy in Boston is still 5% - half the national average and at equilibrium. It is also important to note that the supply of remodelled homes was extremely low in Boston/Cambridge in 2000, since many multi-families had been left derelict after 25 years of rent control, resulting in deferred capital imrovements. Rent control only ended in 1997.

1989-1993 was a recession during which a huge number of jobs were lost in the wake of a massive construction boom in the 1980's, fueled in part by tax benefits that were phased out for FY1987. The reduction in demand in the phase of supply delivered in 1987-1989 from projects that broke ground in 1985-6 led to the huge correction in prices, one that the 3% drop in interest rates could not counter.

But we are now facing a substantially different environment: we have favorable factors like net job growth and limited new supply but negative factors like rising interest rates and historically high prices relative to income. What is happening in my view is that in Massachusetts the current net job growth is being negated by retirees leaving the state, resulting in the situation we see now: continued strength in demand (from job-holders) and more supply (from emigrants, much more than from new construction). Interest rates are, of course, taking a toll on demand.

And if indeed we were to have even a mild recession with job losses now, prices would undoubtedly fall hard.

Indigo: As DT points out we clearly have a buyer's market, as reflected in the current absorption rate (inventory/trailing sales) or months of supply. The current absorption rate only indicates the current state of the market and does not correlate to the future absorption rate.

Projected job growth is relevant to future absorption because it increases the demand for housing (presumably, not necessarily, at a ratio of existing jobs to households).

Since job growth, outmigration, and interest rates are unpredictable, so indeed is the future demand for housing.

Post a Comment