March Market Wrap

Results for March were posted today by the Massachusetts Association of Realtors (link). Before going to the results, let me remind you that the March numbers represent sales typically originated in the preceding two months, in this case January and February. Given the mild winter of 2006 (especially January) and the brutal winter of 2005 (blizzard), I was expecting a nice bump in the numbers. Sales were up, but barely (about 2% yoy),, and prices were down for SFHs and up only slightly for condos.

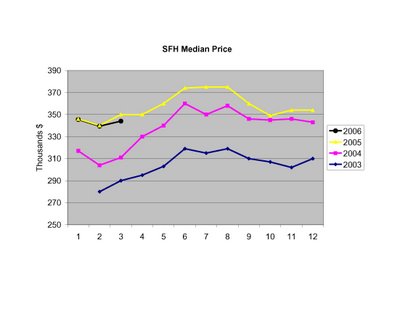

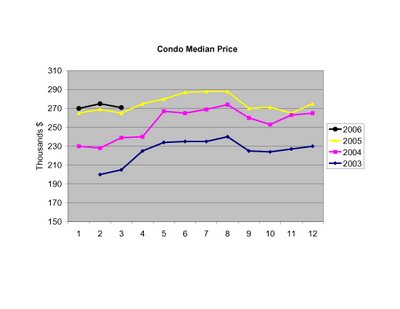

Here are the median sales price data for March:

SFH prices were down 1.7% relative to last year. Cumulative 1st quarter prices are also down. These results clearly demonstrate falling SFH prices on a statewide level.

Condo median prices were up 2.2% relative to last year, and will be up about the same for the 1st quarter. (Up in nominal terms, but down in real terms) Last year in the 1st quarter condo prices were appreciating at ~14%, so the market deceleration is clear.

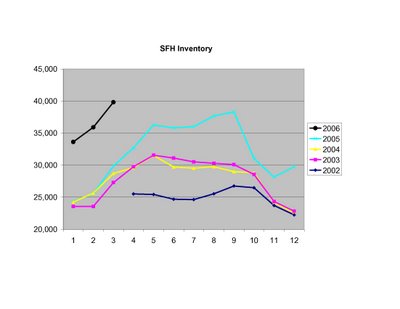

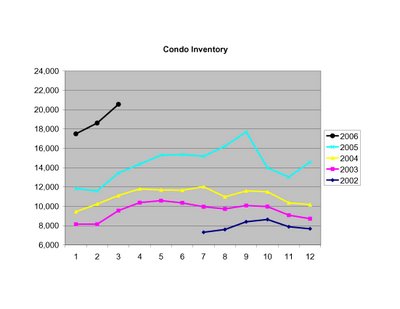

Inventory numbers continue to surge. According to MAR, inventory levels are the highest in more than a decade - and they show no sign of slowing.

Notice I had to extend the y-axis range in both plots to accomodate the growing inventory of unsold homes.

Notice I had to extend the y-axis range in both plots to accomodate the growing inventory of unsold homes.

Similar MA sales and price numbers were also released today by the Warren Group, as reported in the Boston Globe (here).

6 comments:

That condo inventory number seems poised for a moonshot. I'll be curious to see how high it goes in the next 9 months, especially as late arriving "investors" bring units into the market, and buyers sit on the sidelines. Yikes.

Realtors and other cheerleaders have enjoyed a long bull run, but this is shaping up to be a colossal slo-mo trainwreck.

Inventory is high, but it's just as likely to get absorbed by rising demand (driven by 20,000 new jobs created last year and another 20,000 projected this year) as it is to increase. Let's face it: no one knows what direction inventory will go. If inventory stays where it is now and demand stays strong prices are unlikely to correct sharply. Inventory would have to stay high and demand would have to decline for there to be any significant effect on prices.

Months of supply is also usefully measured as inventory divided by trailing twelve month's sales. Condo inventory, by this measure, is 10.5 months, indicating a buyer's market, but not a freefall market. Sales activity remains brisk in March and April, by all reports.

Wathamite & NotSoFastLouie,

Are you on crack?

1.) Massachussetts unemployment is higher than the national average. We lost something like 2 million jobs after the DotCom crash and we're still haven't gained all of those back.

2.) Massachussetts is one of the two WORST states for losing population (the other being NY). The majority of that population is in the 25-35 demographic, i.e. your typical first time buyers. Just wait until the retirement boom happens and all the grey hairs leave for Florida, South Carolina and Arizona. We'll be hemmoraging population at that point.

3.) ~6 months of inventory is considers a "balanced" market. A "buyers" market is considered around ~7-8 months of inventory. Over the last couple of years Mass has been at ~4-5 months of inventory. It should be EXTREMELY worrisome that we're approaching ~11.5 months of inventory. This isn't just a buyer's market, this is a bloodbath waiting to happen.

4.) We're already one of the highest places to live only behind CA & NY. Estimates put the current housing market at 20-30% overvalued.

5.) Housing markets have typically been "affordable" historically when cost of a house is 3x annual income. Massachussetts is sitting at 5.5-6 times annual income currently.

6.) Market fundamentals for the housing industry is the rental ratio, i.e. if you had to rent it out what could you get versus what your mortage is. In a "sound" market a house should be worth around 10 times what it can rent for a month. Current market prices are well over 20 times what a place could rent out for. Prices are no longer tied to market fundamentals but to speculation about future returns. Sound familiar? This is the same exact thing that happened with the stock market bubble when prices got divorced from P/E ratios and were based on "future earnings".

7.) Incomes have been flat for the past 3 years.

8.) Foreclosures in Massachussetts have shot up over 100% in the last two years.

9.) The buying frenzy was supported by historically low intrest rates, and exotic mortages (ARMs, 0% down, no document loans, etc). The majority of these loans are set to adjust in the next two years (a couple billion this year, and $1.7 TRILLION next year). The adjustments on these loans are likely to mean thousands of dollar differences in mortage payments.

10.) The REAL year over year price declines for SFH have come at a time when the Real Estate industry was claiming that real estate NEVER goes down in value, and that it's a solid investment.

These are FACTS, there is no "truthiness" behind the fact that prices are in decline.

thelivense,

I agree with nearly all of the points that you bring up. One minor oversight: the job loss in MA from the Dot Com meltdown was estimated at 200,000 jobs, of which we've recovered less than a quarter.

"This data does not predict a future crash. The greatest rational for an upcoming steep price decline seems to be 'prices FEEL high and so they must fall."-Walthamite

Maybe we haven't been looking at the same data, but it doesn't have anything to do with "Feeling", except maybe flippers "Feeling" scared shitless because they do see the data.

Prices for condos and SFH's are at historic highs relative to incomes. Inventories are shooting to the moon. Buyers have been reaching to get into properties with easy credit and high risk mrtgs. Thelivense pointed all of this out in his post, and the graphs posted by DT show the trends.

"the housing slowdown will be a brutally boring and uneventfull affair of low appreciation till eveyone forgets what they were ever expecting to happen in the first place."

What data would it take for you to believe that we are heading for a future crash?

Please tell me that you're kidding.

Post a Comment