January Market Wrap

MAR released their January sales report today. Here are the latest SFH numbers plotted to show their relationship to recent trends over the past few years.

Here are the latest price and inventory data for Condos.

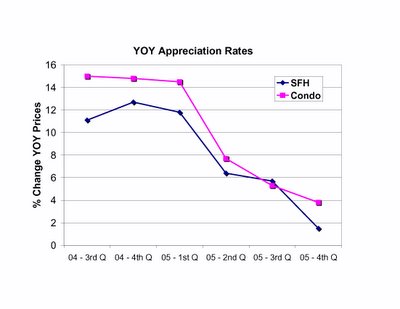

So far it hasn't made the headlines that I've seen, but prices are DOWN (albeit slightly) year over year for SFHs. This breaks a string of 115 consecutive months of positive appreciation.

So far it hasn't made the headlines that I've seen, but prices are DOWN (albeit slightly) year over year for SFHs. This breaks a string of 115 consecutive months of positive appreciation.

And inventory numbers continue to accelerate to the upside - looks like I'll need to expand the y-axis for these plots by summer.

Money quote from MAR press release:

"...sales of detached single-family homes fell to their lowest January level in 10 years..."

Spin from the MAR Talking Points:

"False assertions of a price bubble in the local market also have prompted some buyers to delay their home buying decision in anticipation of sharply lower prices come this spring."

"Inventory, as stated in months of supply also rose steadily from 8.2 months last January to 14.3 months of supply in January 2006... In Massachusetts, the market is at equilibrium for buyers and sellers when 7.5-8.5 months of housing supply exists, thus despite concerns about an inventory glut, there’s a healthy balance between supply and demand at the present time."

As noticed by a reader, the statement above has been edited by MAR. The new text is shown below, and now reflects a more "reality-based" assessment of the market:

"In Massachusetts, the market is at equilibrium for buyers and sellers when 7.5-8.5 months of housing supply exists, thus a strong buyers market emerged has emerged over the past month due to surging supply levels and more moderate demand."

"The number of condos for sale has increased 47.8 percent in the past year... Inventory, as stated in months of supply, also has risen in the past year, climbing to 13.7 months of supply

this past January from 9.5 months of supply in January 2005."

To see where these "balanced" inventory numbers will likely be sending prices, check out my recent post.

But in case anyone might be worried about the market, MAR is here to reassure you:

"Predictions of steep price declines in home values made this past fall remain largely unfounded."

How about long, slow grinding declines in home values for years to come? All the pieces are in place: exploding inventory, record low affordability, net out-migration, stagnant job growth and wages, uptrending foreclosures, payment shock from resetting mortgages. The only questions now seem to be: How fast, and how far down?