Affordability is THE problem

There's been talk recently about a potential bottom in the local and national real estate markets. After all, the economy is still growing, mortgage rates are low, what could keep our local market from re-igniting? In a word - affordability. Prices in MA rose much faster than incomes for the last 7 years. Sure mortgage rates are low, but can't we figure in the effect of mortgage lending rates to see if they compensate for the high prices? I've assembled three plots from a variety of sources that attempt to do just this.

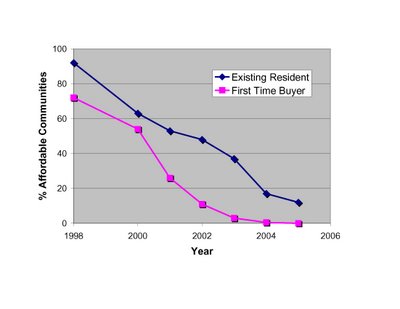

First up is data from "The Greater Boston Housing Report Card 2005-2006" available as a PDF from CHAPA (PDF here). Lots of great information available in the report, but let's focus on their affordability analysis. Here is their description of how they estimate the number (and percentage) of communities affordable to existing residents and new buyers throughout Massachusetts in 2005:

A municipality’s housing is considered “affordable” for this analysis if the annual cost of supporting a mortgage, real estate taxes, and homeowners insurance does not exceed one-third of the annual median income of households in that community. CURP also estimated the affordability gap for those unable to come up with a 20 percent down payment. Considered a “first time homebuyer” analysis, the calculation is the same but both the homebuyer’s household income and the purchase price of the home are estimated to be just 80 percent of the median for the community and the down payment is assumed to be 10 percent.

Note this analysis does not tell you anything about how affordable each community is, just how many communities meet their threshold of affordability. But also note that their analysis takes into account the prevailing mortgage rates, local taxes, and insurance. Here are the historical figures from their analysis: Clearly, we are reaching unsustainable lows when ZERO communities are affordable to "first time buyers," and ~10% are affordable to existing residents.

Clearly, we are reaching unsustainable lows when ZERO communities are affordable to "first time buyers," and ~10% are affordable to existing residents.

Next up is the National Association of Home Builders - Wells Fargo Housing Opportunity Index (available here). From their press release:

The NAHB/Wells Fargo HOI is a measure of the percentage of homes sold in a given area that are affordable to families earning that area’s median income during a specific quarter. Prices of new and existing homes sold are collected from actual court records by First American Real Estate Solutions, a marketing company. Mortgage financing conditions incorporate interest rates on fixed- and adjustable-rate loans reported by the Federal Housing Finance Board.

High readings on the HOI index means greater affordability. From the NAHB data, it doesn't look like now is an "opportune" time to try to purchase a house in the Boston area.

Last up is an analysis performed by Moody's Economy.com, and featured on the NY Times website as an interactive graphics tool (link here). Plotted below is the % of income local buyers had to pay for mortgage costs (no taxes or insurance) to buy a house in three MA Metro Divisions since 1979. Again, their analysis takes into account prices, incomes, and finance costs.

The cost to service a mortgage in these areas is near or above the unsustainable levels reached at the last market top in the late 80's.

The cost to service a mortgage in these areas is near or above the unsustainable levels reached at the last market top in the late 80's.

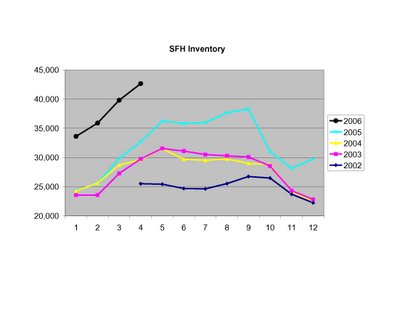

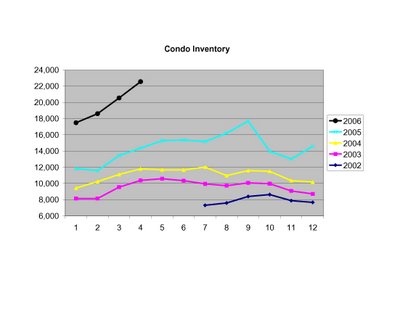

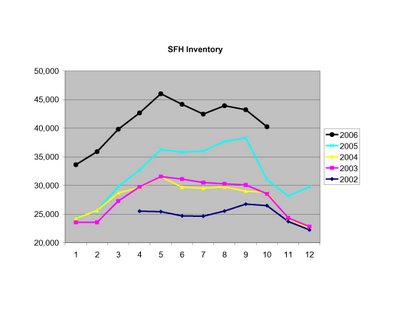

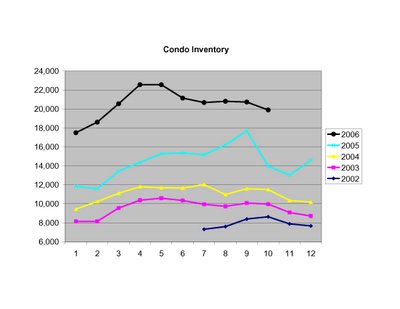

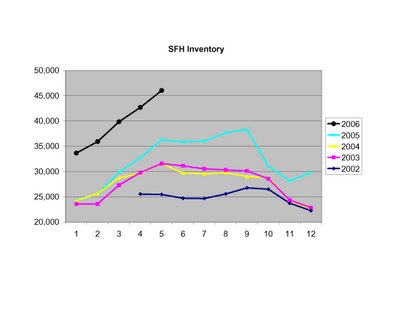

To put the current unsold inventory into perspective, here are the historical numbers according to MAR:

To put the current unsold inventory into perspective, here are the historical numbers according to MAR:

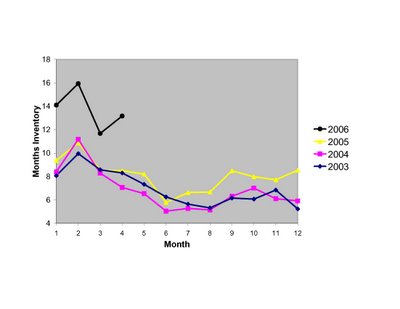

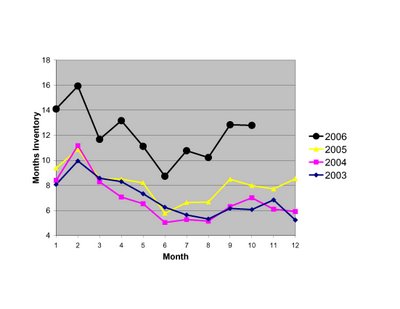

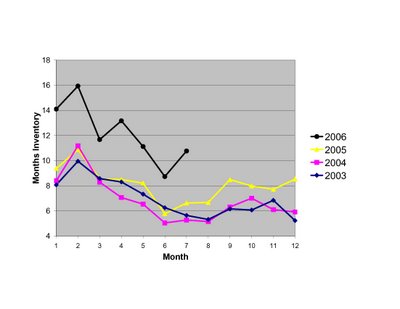

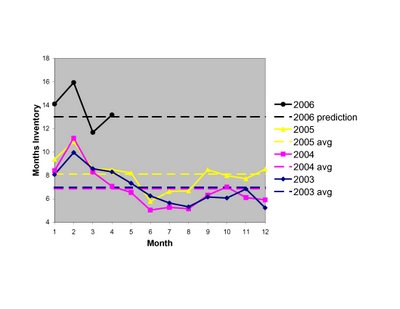

Finally, here is a look at months inventory (total SFH and condo inventory/total sales):

Finally, here is a look at months inventory (total SFH and condo inventory/total sales):

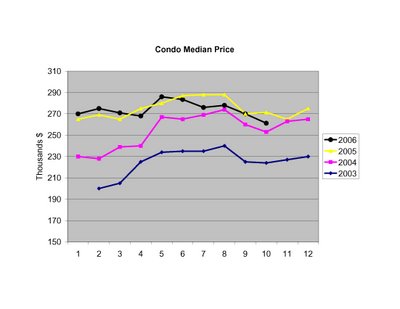

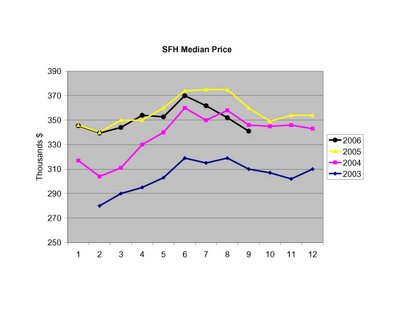

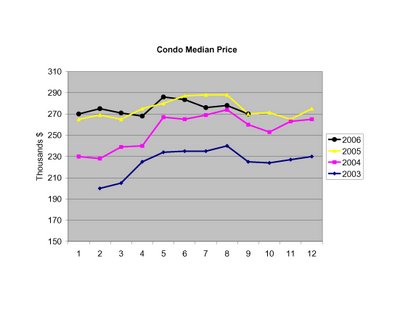

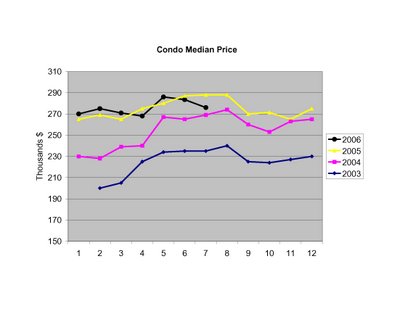

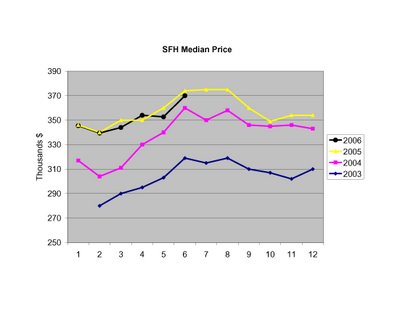

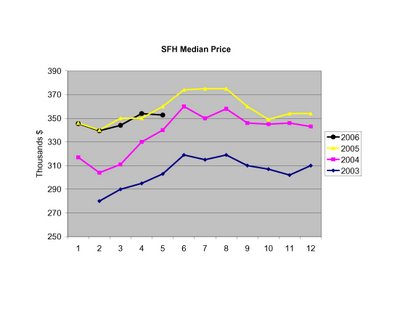

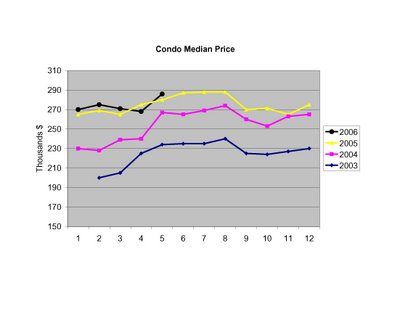

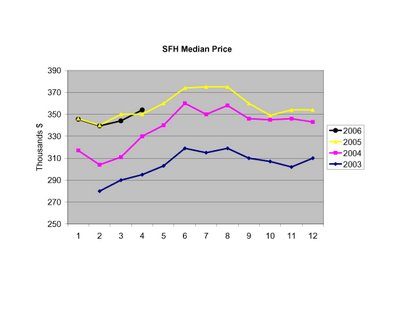

SFH prices for September are ~5% below 2005 levels, and ~1.5% below 2004 levels. The median price for sold condos was level with 2005.

SFH prices for September are ~5% below 2005 levels, and ~1.5% below 2004 levels. The median price for sold condos was level with 2005.

Quotes of the month in reaction to these numbers:

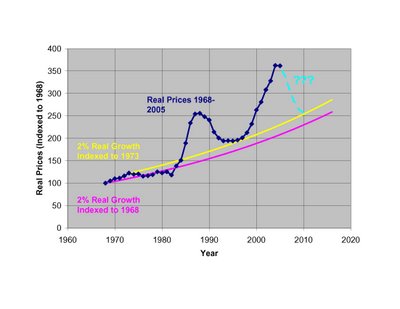

Quotes of the month in reaction to these numbers: It is commonly observed that housing prices over the long term rise ~1-2% faster than inflation. This historical relationship derives largely from the fact that incomes in America have, over the long term, risen faster than inflation. Hence, a higher standard of living, and the ability to pay more for housing. To help visualize what the long term trend might look like in an ideal world, I've included trendlines to show 2% real annual increases indexed to 1968 and 1973. You could do the same trendline starting with any year.

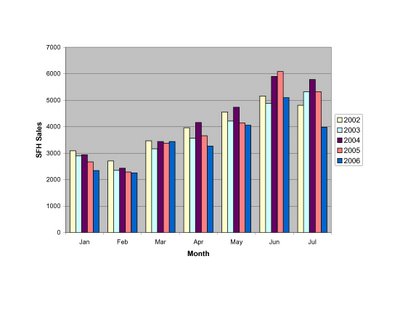

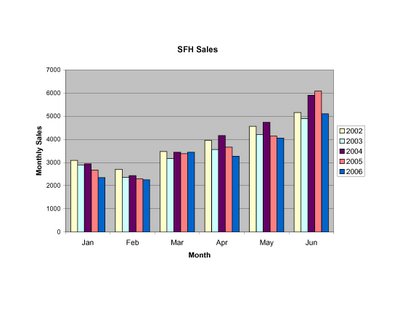

It is commonly observed that housing prices over the long term rise ~1-2% faster than inflation. This historical relationship derives largely from the fact that incomes in America have, over the long term, risen faster than inflation. Hence, a higher standard of living, and the ability to pay more for housing. To help visualize what the long term trend might look like in an ideal world, I've included trendlines to show 2% real annual increases indexed to 1968 and 1973. You could do the same trendline starting with any year.  The slowdown in SFH sales appears to be accelerating this summer.

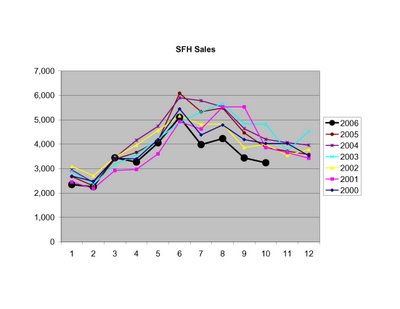

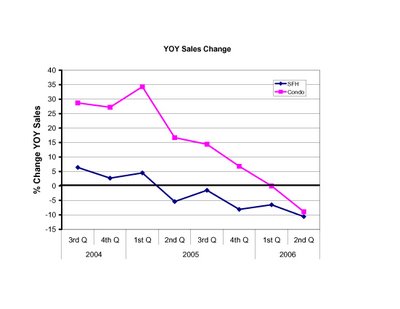

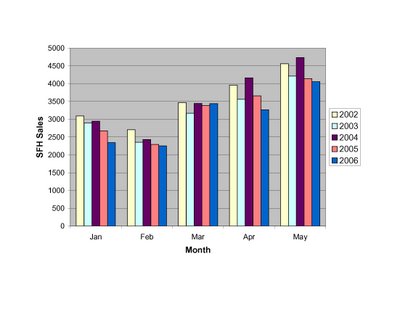

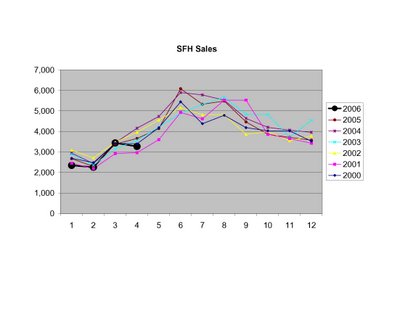

The slowdown in SFH sales appears to be accelerating this summer.

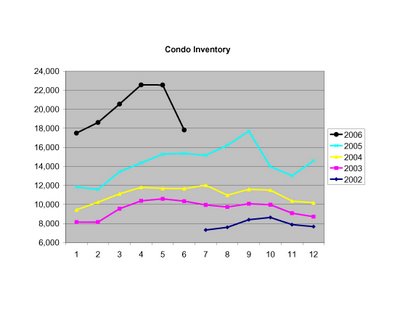

(Note the inventory numbers reflect corrections for June by MAR).

(Note the inventory numbers reflect corrections for June by MAR).

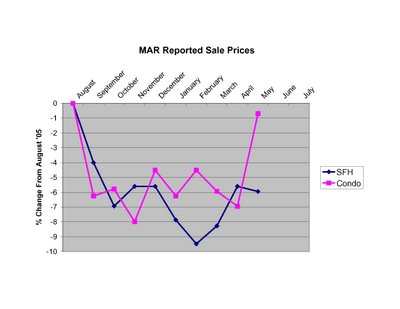

Prices for both SFHs and Condos were DOWN ~1% compared to the same month last year. Sales were also off, 17% for SFHs and 14% for Condos:

Prices for both SFHs and Condos were DOWN ~1% compared to the same month last year. Sales were also off, 17% for SFHs and 14% for Condos:

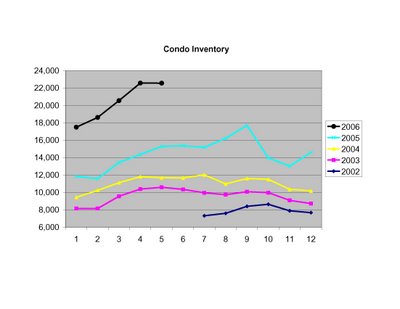

Reported inventory numbers seem absurd:

Reported inventory numbers seem absurd:

Any explanations? Houses flooded by the spring rains? Sellers giving up?

Any explanations? Houses flooded by the spring rains? Sellers giving up?

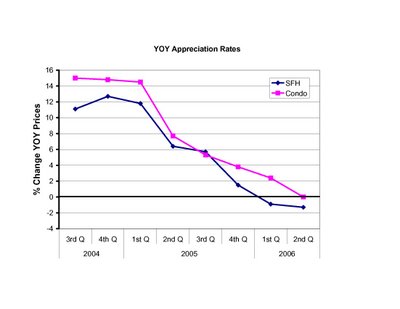

Clearly prices are down from the peak, even though condo prices made a strong move recently. But is this spring exhibiting typical strength? The short answer is NO. From the peak in '03 to May of '04, SFH prices went UP ~7% and condo prices went UP ~12%. From the peak of '04 to May of '05 SFH prices went UP ~1% and condo prices went UP ~2%. From last year's peak to this May, SFH prices are DOWN ~6% and condo prices are DOWN ~1%. Not huge, but clearly negative.

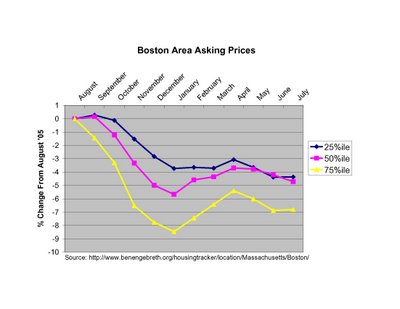

Clearly prices are down from the peak, even though condo prices made a strong move recently. But is this spring exhibiting typical strength? The short answer is NO. From the peak in '03 to May of '04, SFH prices went UP ~7% and condo prices went UP ~12%. From the peak of '04 to May of '05 SFH prices went UP ~1% and condo prices went UP ~2%. From last year's peak to this May, SFH prices are DOWN ~6% and condo prices are DOWN ~1%. Not huge, but clearly negative. While the spring bounce in prices is apparent from the plot, asking prices peaked rather meekly in April well below last August levels, and asking prices have since returned to a downward trajectory. This is NOT a strong sign for prices for the remainder of the summer and the rest of the year.

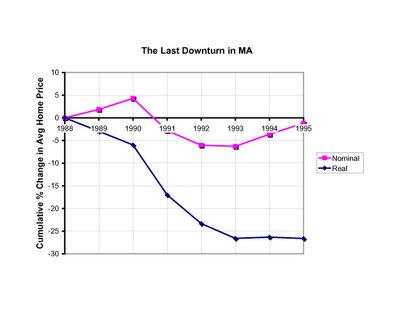

While the spring bounce in prices is apparent from the plot, asking prices peaked rather meekly in April well below last August levels, and asking prices have since returned to a downward trajectory. This is NOT a strong sign for prices for the remainder of the summer and the rest of the year. Note that while this previous market shakeout is regarded by many as a "housing bust", the biggest nominal decline in prices in a single year was only ~7% (from 1990 to 1991). Notice also that once the market started slowing the biggest declines took time (2-3 years) to develop, and the recovery was agonizingly slow. Food for thought when you hear talk of soft-landings and impending market rebounds.

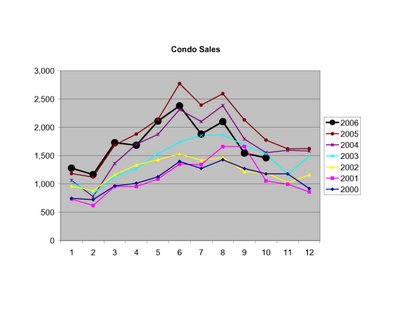

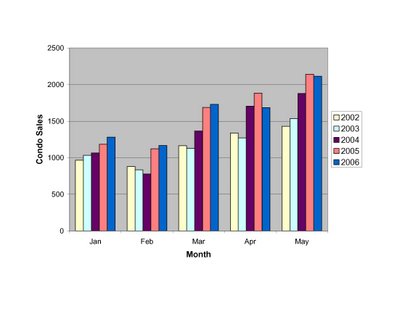

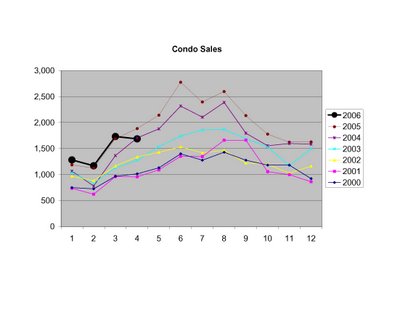

Note that while this previous market shakeout is regarded by many as a "housing bust", the biggest nominal decline in prices in a single year was only ~7% (from 1990 to 1991). Notice also that once the market started slowing the biggest declines took time (2-3 years) to develop, and the recovery was agonizingly slow. Food for thought when you hear talk of soft-landings and impending market rebounds. In contrast, Condo sales have continued to set records until the past couple months. A momentary blip, or worrying trend?

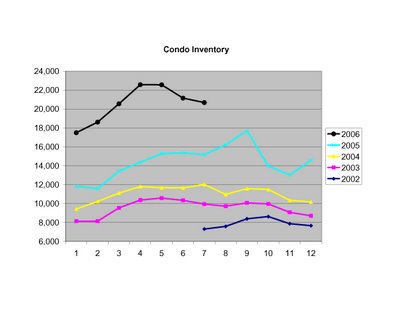

In contrast, Condo sales have continued to set records until the past couple months. A momentary blip, or worrying trend?

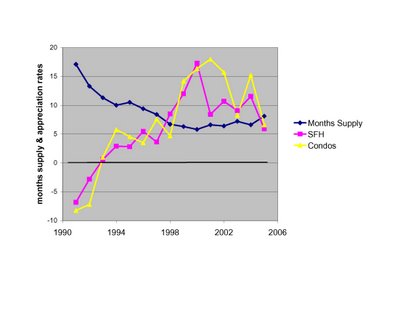

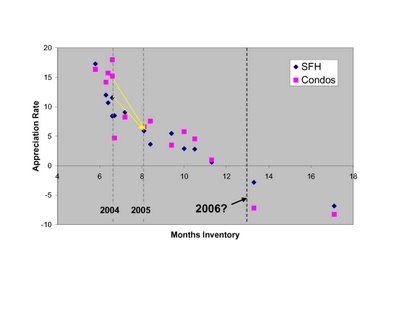

Now going back further in time and using the average months inventory for each of the past 15 years, I've plotted the appreciation rates for SFHs (blue) and Condos (pick) as a function of the average inventory for each year. There is a clear inverse relationship between inventory and appreciation rates. To emphasize the shift in the market, I've included dashed lines showing the inventory levels for 2004, 2005, and the guesstimate for 2006. The yellow lines connect the 2004 and 2005 data points, showing the downward trajecory that began last year.

Now going back further in time and using the average months inventory for each of the past 15 years, I've plotted the appreciation rates for SFHs (blue) and Condos (pick) as a function of the average inventory for each year. There is a clear inverse relationship between inventory and appreciation rates. To emphasize the shift in the market, I've included dashed lines showing the inventory levels for 2004, 2005, and the guesstimate for 2006. The yellow lines connect the 2004 and 2005 data points, showing the downward trajecory that began last year. As some have commented, even as inventories have ballooned over the past year sales have remained historically robust in MA, especially for condos. To some this is a sign of a strong but more balanced market. To others this is an ominous trend, as any slip in sales could further shift the market balance, which is already adding inventory at a steep rate.

As some have commented, even as inventories have ballooned over the past year sales have remained historically robust in MA, especially for condos. To some this is a sign of a strong but more balanced market. To others this is an ominous trend, as any slip in sales could further shift the market balance, which is already adding inventory at a steep rate.

Clearly the future is not something we can predict with 100% accuracy. But the data I've presented here, in the context of historical market behavior, indicate to me a high likelihood that prices will continue to drop. The RE market is incredibly complex and has a number of interrelated moving parts (population changes, income changes, mortgage rates, 2nd home and investor activity, rental prices, new construction, etc) but sometimes the message from supply and demand is all you need to know. This, I believe, is one of those times.

Clearly the future is not something we can predict with 100% accuracy. But the data I've presented here, in the context of historical market behavior, indicate to me a high likelihood that prices will continue to drop. The RE market is incredibly complex and has a number of interrelated moving parts (population changes, income changes, mortgage rates, 2nd home and investor activity, rental prices, new construction, etc) but sometimes the message from supply and demand is all you need to know. This, I believe, is one of those times.

The unsold inventory of SFHs continues to surge...

The unsold inventory of SFHs continues to surge...